Imagine this: ATMs, those handy machines that give us quick cash and banking services, have become an inseparable part of our daily routines. But hey, with the surge of digital dangers lurking around, we’ve got to keep our guard up and make ATM security our top priority.

Even in the safe haven of Singapore, renowned for its rock-solid security, we’ve got to stay on our toes and adopt specific measures to ensure a banking experience that’s safe and sound. So, let’s dive into these seven ATM security tips that are essential knowledge for anyone in Singapore, giving you the power to protect your hard-earned money.

Understanding Common ATM Scams

ATM scams are prevalent around the world, and Singapore is no exception. Being aware of these scams is crucial to protect yourself from falling victim to fraudsters. Let’s take a closer look at some common ATM scams targeting users in Singapore:

- Skimming: Skimming involves criminals attaching devices to ATM card slots to capture card information and PINs discreetly. These devices are often designed to blend in with the ATM’s appearance, making them difficult to detect.

- Card Trapping: In this scam, fraudsters use various methods to trap a user’s card inside the ATM. They may use a thin film or sticky material to prevent the card from ejecting properly, giving them an opportunity to retrieve it later.

- Shoulder Surfing: This technique involves criminals observing or recording the user’s PIN as they enter it on the ATM keypad. They may use hidden cameras, and binoculars, or simply stand close enough to visually capture the PIN.

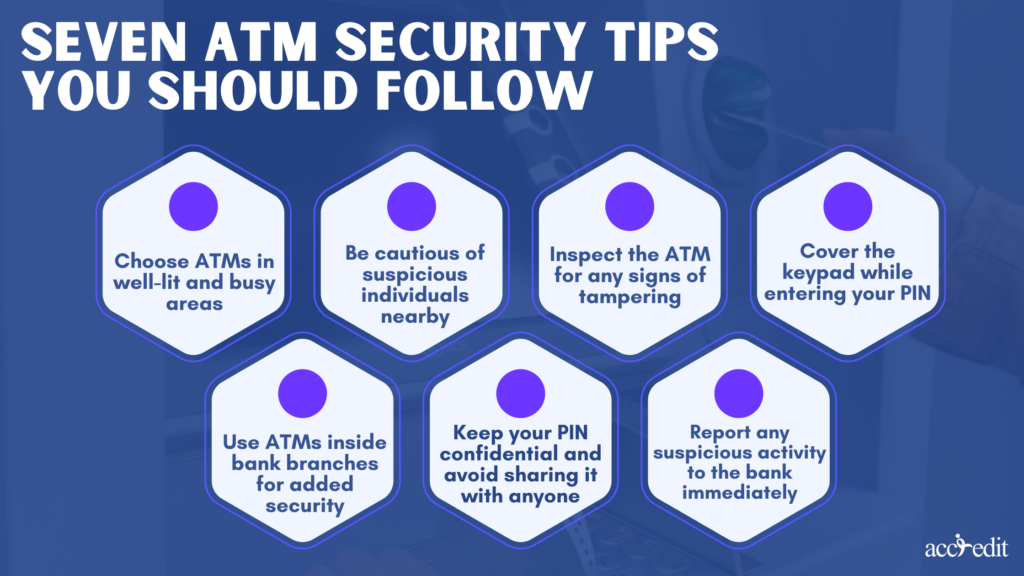

Ten ATM Security Tips You Should Follow

Now that we are aware of the common scams, let’s explore seven essential ATM security tips that will help ensure your safety while using ATMs in Singapore:

1. Choose ATMs in well-lit and busy areas

When it comes to choosing the perfect ATM spot, go for those tucked away in well-lit areas bustling with people. You see, criminals tend to shy away from ATMs that are easily seen by passersby. So, aim for those situated inside shopping malls, banks, or near crowded spots. And hey, if you can, pick ATMs that have their eyes on you with those nifty CCTV cameras. It’s a little something that keeps the bad guys at bay.

2. Be cautious of suspicious individuals nearby

Here’s the deal: when you’re at the ATM, it’s crucial to stay on high alert and keep an eye out for anyone acting fishy nearby. If you spot someone lingering around or giving way too much attention to what you’re doing, it’s wise to hit the cancel button and find a different ATM. Trust your gut and make your safety the number one priority.

3. Inspect the ATM for any signs of tampering

Before you dive into using that ATM, it’s crucial to give it a quick inspection for any signs of tampering. Take a close look and keep an eye out for any loose parts, strange gadgets or attachments, and anything that just doesn’t belong. If you spot anything fishy or suspicious, don’t hesitate to report it to the bank right away. Remember, it’s always better to be safe than sorry.

4. Cover the keypad while entering your PIN

Here’s a handy tip to safeguard your PIN: as you enter those secret digits, make sure to shield the keypad with your hand or body. By doing this, you’ll thwart any potential visual snoops trying to snatch your code. It’s a simple move that adds a mighty layer of protection against those pesky shoulder surfers. Just remember, your PIN is meant to stay confidential, so keep it under wraps.

5. Use ATMs inside bank branches for added security

For an extra layer of security, aim to use ATMs that you’ll find inside bank branches. These particular machines boast a higher level of safety, thanks to their close ties to the bank’s robust infrastructure and watchful surveillance systems. Criminals tend to steer clear of ATMs nestled within a bank branch because they know these machines are closely monitored at all times.

6. Keep your PIN confidential and avoid sharing it with anyone

Let’s talk about that secret code that unlocks the door to your bank account: your PIN. It’s like a precious key that you should guard with all your might. Don’t go sharing it with anyone, not even your closest buddies or beloved family members. Keep it close to your chest because here’s the deal: financial institutions will never ask you for your PIN. So, if someone ever does, raise those eyebrows and be suspicious. Remember, protecting your PIN is the shield that keeps unauthorized access away from your hard-earned cash.

7. Report any suspicious activity to the bank immediately

If you happen to come across anything out of the ordinary while using an ATM—like malfunctioning buttons, unexpected messages popping up on the screen, or even bizarre noises—it’s crucial to notify the bank without delay. Your quick response plays a vital role in thwarting potential fraud and safeguarding fellow users. By reporting any suspicious incidents, you actively contribute to upholding a secure banking environment. Remember, it’s all about taking action and staying one step ahead.

Final Thoughts

Your utmost concern should revolve around safeguarding your personal and financial data whenever you use ATMs. It’s crucial to acquaint yourself with common scams and hold on tight to these crucial pointers: go for well-lit ATMs, stay alert for suspicious individuals, meticulously inspect for signs of tampering, shield that keypad from prying eyes, give preference to ATMs housed within bank branches, guard your PIN like a fortified vault, and promptly report anything suspicious. By fortifying your precious cash, you can savor the tranquility that accompanies a secure banking encounter.

Accredit Moneylender: Your Trusted Source for Quick and Secure Cash Solutions

In search of fast cash with a trustworthy lending experience? Look right here at Accredit Moneylender, the go-to lender in Singapore. Rest assured, we prioritize the security and confidentiality of your personal information.

With our conveniently situated branches spread across Singapore, accessing our services is a breeze. Whether you’re envisioning a home transformation, plotting a dream wedding, or embarking on an exciting renovation project, our personal loans are designed to cater to a variety of needs.

Don’t hesitate any longer—take the leap and experience the hassle-free borrowing journey with Accredit Moneylender today.